Because many young adults have packed schedules, finding a tool to save time is always desirable. This idea applies to managing our money, too. We would like to be on top of our finances, without wasting too much time.

If you want to manage your money without collecting receipts, writing down a budget, and punching a calculator, then Mint.com is the answer. It’s the best personal finance and automated software I’ve found. Mint is easy to set-up, quick to connect to your banking institutions, and completely free.

After you connect your banks and credit cards, the homepage is a one-stop shop for your finances.

Mint.com’s homepage offers a live total of the balance of all your accounts and credit cards, your net worth, your credit score, alerts of overspending or low account totals, upcoming bills, budgets, and goals. Plus, the website’s design is simple and high-quality, making the money-management process more enjoyable.

The website and mobile app offer many different features. But, my two favorite features from Mint are titled Goals and Budgets.

Goals

I believe it’s most important start with your financial goals. Because when you know what goal you want to accomplish, you’ll have a built-in purpose for budgeting and tracking your expenses.

I’ve written about the importance of written goals before, and Mint allows us to do that digitally. The quick summary of their Goals feature is for the user to define the goal, their current funding, and then set a target date. The application then determines how much money you need to contribute based on those settings.

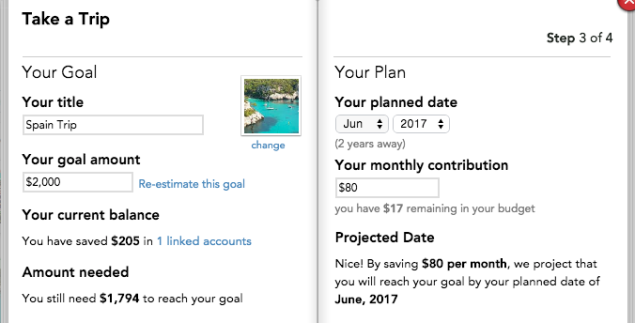

For example, the image below shows my goal of traveling to Spain in 2017, and gives you a general idea of the interface and concept for the Goals feature.

To set this up, I simply typed in how much money I thought I would need (roughly $2,000). I spent five seconds linking an account of mine to fund the vacation (Not shown above, but will pop-up.) Then, on the right side, I decided to plan by the date of June 2017. The software instantly told me I need to contribute $80 a month (I graduated and now have a full-time income, so I contribute way more than I would have in college).

As easy as that, and it only took a couple of minutes. Plus, (if you’re into it) you can upload a motivational image for greater inspiration, as I did with a Spanish beach.

Smart financial decisions are some of the most important actions in life. That’s why you will thank yourself later for setting money-related goals; and Mint makes the process appealing with its form and function.

Keep contributing money, even if it’s in small increments, and be patient to accomplish your savings goal.

Budgets

Now we know what we are aiming for, use Mint’s Budgets feature to work together with your goals. While budgets aren’t always sexy, having money to afford college, entertainment, and vacations is.

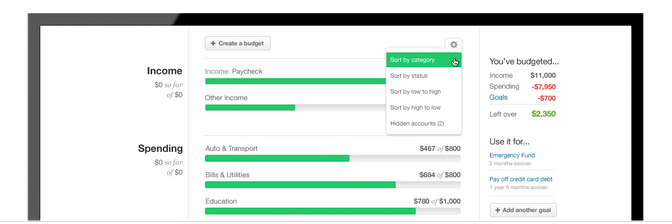

Below is a screenshot of Mint’s Budget feature (random sample, not my budget).

In reference to the image, simply click ‘+ Create a budget’ and select a category. The categories include any possible expense you can have. In my budget, I use the spending categories Gas & Fuel, Business Services, Entertainment, Gifts & Donations, Shopping, and Food & Dining. Next, select an amount you want to spend each month (it’s super easy to change this amount if you need to later).

In reference to the image, simply click ‘+ Create a budget’ and select a category. The categories include any possible expense you can have. In my budget, I use the spending categories Gas & Fuel, Business Services, Entertainment, Gifts & Donations, Shopping, and Food & Dining. Next, select an amount you want to spend each month (it’s super easy to change this amount if you need to later).

Then when you charge your debit or credit card, Mint will automatically add that cost to the correct category and overall budget spending. In other words, it does all the work for you!

Sometimes the software will code an expense differently than you want, but you can manually change it in the Transactions tab. Once you correct the category of an expense, I haven’t had any problems with Mint coding it incorrectly again.

Additional Features

There are more tabs and features of Mint.com than the ones mentioned—like Trends, Investments, and Ways To Save—but I don’t find those as useful. Maybe you will.

The one part where the Trends tab can be uniquely helpful is its pie chart display that compares your spending categories. Otherwise, I stick to focusing on the activity of my Goals and Budgets.

Can You Trust Mint?

I believe you can trust Mint.com because Intuit ultimately owns the website. Since Intuit’s name and reputation rely on the site’s security, they’re going to be sure that Mint.com is safe for consumer use. If it wasn’t safe, Intuit would face major backlash and problems on their end.

Readers, do you currently budget, or do you have a wing-it approach to your spending? What financial goals have you set? Are there other personal finance services you like better?