Do you want to know the best savings account for 2017?

You must be smart. Because saving money speeds up the process to financial freedom and wealth.

It’s best explained through this equation:

The more you save, equals the more you can invest.

The more you invest, equals the more money working to make you money.

The more money working for you, equals the more your money multiplies and adds zeros to the end of your bank account balance.

The effects of this are life-changing. If you save (and invest) enough, you can shave off decades of work to retire early or do something regardless of how much money it pays. Wouldn’t that be unbelievable?

Remember, this won’t happen if you don’t start with step one of the equation: saving your money. That’s the fuel that gets this money-making process moving.

Beyond saving money to invest, it’s also wise to save money for vacations, emergencies, and future big expenses.

Bottom line, saving money makes your life easier and more enjoyable.

But trying to save money through a checking account, where your spending money is, makes your finances messy and difficult to save. I’ve found you’ll save far more money if you set up a savings account outside of your checking account.

And you don’t want any savings account that comes with your bank, because not all savings accounts are the same.

The Best Savings Account

From my research and experience, the best savings account is: Capital One 360.

I’ve used this account for years and it’s only treated me with the best service. It’s been so good to me that I actually referred my mom, two sisters, and girlfriend to it. (Capital One should pay me as a sponsor—oh, well.)

Besides my great results with it, here’s why I’m all on board the Capital One 360 train.

Why This Savings Account Helps You Accomplish Your Goals

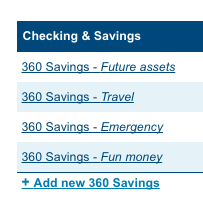

For all of the reasons you’re going to read below, I have four different savings accounts with Capital One 360.

See those four accounts in the image above? I’ve set up automatic transfers each month that deposits money from my checking account into each savings account.

After setting it up the first time, I never need to touch this again and it will continue to work for me. (Realistically, I never need to think about it again.) This is now all hands off, guaranteed savings that push me closer to my financial goals.

And as I alluded to earlier, having this money in savings accounts separate from my checking account all but ensures no frivolous spending happens.

I mean I could transfer it over to my checking account, wait two days, and then spend it. But that’s a drawn out process, which works as a built-in safety net to make sure the purchase is worth it. Most of the time the purchase isn’t worth it in the long-term.

Those automatic results and protecting you from your own spending habits are two reasons why I’m convinced you would benefit from opening a Capital One 360 account.

While those two are the biggest motivators, there are other bonus benefits that come with this:

- No fees and no minimum balance required to open or keep an account

- A high interest rate (high compared to most bank interest rates in 2017)

- Deposit checks with your mobile phone

- Open up to 25 separate accounts with different names (for no charge)

- Links directly to your checking account for easy transfers and direct deposit

- Deposits insured by FDIC

Since Capital One isn’t actually a physical bank—it’s an online one—they save money on the building costs, rent, and employees.

With this money, they can give it back to the customers, like you, based on a higher savings rate (0.75% compared to a normal bank’s 0.01%) and quality customer service.

That means that you can be anywhere in the United States (and most parts of the world) and sign up for this banking service. Because of new and improved online banking, where you live now has nothing to do with what bank you use.

Although some obscure banks offer barely higher rates, they often come with weird stipulations like you have to live in Nebraska, for example. And I wouldn’t trade a few percent points to give up all the features of Capital One—that doesn’t make sense to me.

Now you know why I’m convinced this is the best savings account for 2017. Why don’t you join me and we can both benefit from these sweet online banking features?

Open A Capital One 360 Savings Account

Signing up won’t take more than 5 minutes. And the reward of getting an automated saving system is well worth it. Trust me.