Early on, you realised you were cut from a different cloth. While colleagues followed your boss’s lead, you thought about how things would be better if you were in control.

In other words, you were born to start businesses, not work in them. You have big dreams, but because you lack the cash, you can’t act on them. Whether you’re based on the web or on the High Street, it takes money to make money.

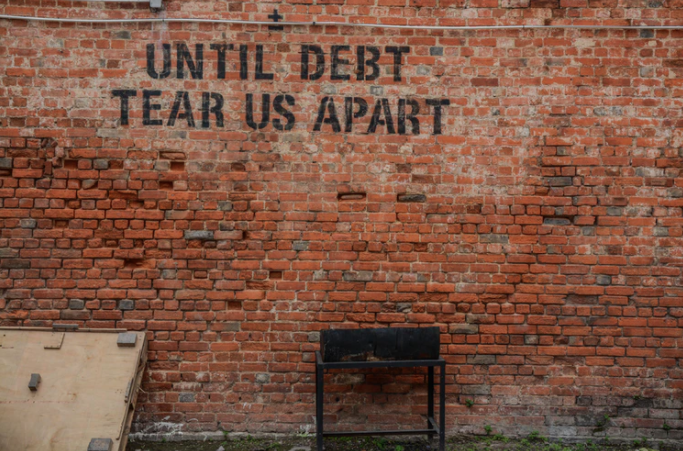

We’ll be honest, here – you’re far from the only person to encounter this obstacle. It’s by far the most common issue faced by entrepreneurs. That’s why business loans exist. However, it can all too easy to fall into a debt trap. If you take on loans that aren’t structured properly, the majority of your revenues may end up servicing them.

In today’s blog, we’ll show you how to leverage other people’s money, whilst NOT becoming a slave to it.

Putting The Cart Before The Horse Can Cost You Dearly

When we set out on our entrepreneurial adventure, we think our product will change the world. We develop our product without field testing and then act shocked when we get nothing but crickets in response.

The embarrassment of such a failure is bad enough on its own. However, these businesses often require a capital infusion to get off the ground. You wouldn’t have gotten anything from the Big Four over the last few years. Ever since The Royal Commission started calling witnesses, they’ve all been playing defence.

Because of this, would-be borrowers have turned to private lenders. With scores of players competing against each other, these firms have the incentive to loosen their lending standards. Aspiring entrepreneurs have approached them for funding, with varying degrees of success.

As you might suspect, there’s a catch. These lenders have heightened their risk of ruin. To compensate, they charge more for their loans.

In essence, online lenders = higher interest. Even if you don’t stumble, your monthly repayments will be far higher than if you had got your loan elsewhere. If you do miss a payment, the results can be disastrous.

Private Loan Penalties Can Ruin Your Finances

In business, cash flow interruptions can strike without warning. A sudden downturn in the economy reduces sales by 20% MoM. Coronavirus cripples your Chinese supplier. You launch your unvetted product, which turns out to be a colossal flop.

Faced with keeping the lights on or skipping a loan payment, you choose the latter. The following month, your business loan bill arrives, but with a dramatically HIGHER minimum payment.

What gives? When you signed onto your private loan, you likely neglected to read the fine print. Had you done that, you would have seen terms that penalise missed payments. Since you failed to pay your bills last month, your interest rate has skyrocketed, causing your amount payable to SOAR.

Now, bill payments are gobbling up the lion’s share of your revenue. You have next to no capital available, making it nearly impossible to scale growth.

The business loan trap now has you – if only you had known what you signed up for!

How To Safely Fund Your Entrepreneurial Enterprise

The above scenario scares many away from

entrepreneurship. However, with thoughtful planning, you don’t ever have to end

up in such a vulnerable position.

Start by working your warm network. Your warm network are people that you know

well. Family, friends, and professional colleagues all fall into this column.

Your connections needn’t be wealthy – you can test many business concepts for

less than $100. Often, you can get your idea off the ground for less than

$1,000.

If you need to raise more starting capital than that, consider Kickstarter or

IndieGoGo. Every day, pitchers get the craziest projects funded. It’s all in the

delivery and marketing – put together a compelling pitch and spread the word.

Do this, and you’ll have a real shot!

When Should I Seek Out A Business Loan?

Eventually, though, you’ll run into a problem that requires significant capital to solve. You get so many orders that you can’t self-pack product anymore. Traffic to your site is soaring, sending your hosting bills through the roof. You have the opportunity to make $1 million in revenue in 2020 rather than $100,000, but you need to expand production – and fast!

All these problems can cost tens or HUNDREDS OF THOUSANDS of dollars to fix. When you run into brick walls like these, it’s time to seek out a business loan.

There is good news, though. If you followed the road map we laid out above, you would have likely been in business for at least six months. You’re probably bringing in revenue, and have a clear path to further growth.

All these factors significantly increase the likelihood of getting a loan with good terms. Just the same, there are other boxes you should tick before seeking out financing. Before heading to the bank or applying online, you ought to have a business plan. This document will answer critical questions, like:

- Why do you need a business loan?

- What are your monthly revenue figures like?

- How much do you need?

- Can you afford the repayment amounts, without them impacting operations?

Are you applying for a secured loan? If so, you’ll also require collateral worth more than the amount you need to borrow.

No matter what type of loan you seek, you’ll also need to have your paperwork in order. These documents include, but are not limited to, the following:

- Proof of income

- Financial statements

- Bank statements

Having said all this, seeking loans through

the Big Four is extraordinarily tough these days. In the aftermath of the Royal

Commission, they have substantially tightened their lending requirements. Even

if they do hear you out, you may have to wait weeks to learn the outcome.

Meanwhile, some private lenders can render decisions within one hour. If you’ve

run into cash flow problems, they might be your only alternative. Even so, pay

rapt attention to their terms and conditions – if they apply excessively

punitive penalties, avoid them.

Avoid Taking On Bad Debt Whilst Building Your Business

The myth of the “overnight success” fools countless would-be businesspeople. In most cases, you’ll have to work hard for weeks, even MONTHS, before you notch your first sale.

If you take on loans too soon, you risk getting dragged down by sky-high repayment amounts. By bootstrapping and only taking on financing when you can afford it, you can avoid the business debt trap.