Graduating from college classrooms to business boardrooms is both exciting and unnerving.

Nearly two-thirds of college grads secure a job within six months of graduation, according to the National Association of Colleges and Employers. But every young person makes some minor missteps as they join the workforce and learn to manage their money.

If you’re not careful, however, you could wind up making big mistakes in your first job that you’ll regret for years to come. Whether you’re worried about student debt or just want a decent salary, a bit of knowledge and preparation can help prevent the worst. Here are the biggest mistakes to avoid in your new job.

1. Settling for a Subpar Salary

The money you earn in the first few years after college sets a precedent for your pay in future jobs. According to 2015 data from the Federal Reserve, most workers experience the fastest income growth before turning 35, and those who increase their pay the fastest gain the largest lifetime earnings. In other words, quickly earning raises and salary bumps is one of the best ways to set yourself up for lifelong wealth.

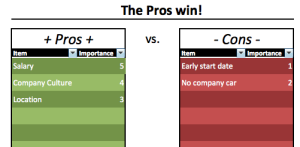

But many recent college grads wind up earning too little for too long. Accepting a lower salary can be a smart strategy to get your foot in the door, but don’t let your pay stagnate. With no previous salary history or experience negotiating pay, you might end up stuck at a lower income.

Here’s what you can do to ensure you’re earning what you’re worth:

- Research the job market. How can you tell if your salary or raise is fair? You’ll need to do some homework about your job market. You can get help from websites such as PayScale, which lets you compare your compensation with similar roles in your area. Or you can check Glassdoor to see if your pay is in line with what your colleagues at your company earn.

- Work toward a raise. Entry-level pay is usually low, so try to outgrow it as soon as possible. Look for ways to stand out and prove your value, such as volunteering for important projects or taking on extra tasks. Keep track of your accomplishments and learn more about how to negotiate pay. When the time comes to ask for a raise, you’ll be ready to show you’re delivering value beyond what you’re making.

- Start building your professional network. Buddying up at work is about more than having someone to eat lunch with. Becoming friendly with your co-workers will help you establish a strong network of people who respect you and your work — and can connect you with better-paying opportunities down the road.

2. Putting Off Retirement Savings

Saving for something that’s decades away is difficult when you have more urgent money concerns. And opening, contributing to, and managing a retirement savings account is complicated, which can be intimidating to young people.

Fortunately, many college graduates’ job benefits make it easier to start saving for retirement. Take advantage of an employer-sponsored 401(k) plan if it’s offered to you and contribute to it regularly. Any starting point is great, even if it’s $25 out of each paycheck. If your company offers a 401(k) match, however, it’s worth contributing enough to take full advantage of it each year.

If your employer doesn’t offer retirement accounts (or even if it does), you can open an individual IRA and set up automatic contributions.

3. Mismanaging Student Loans and Other Debt

Earning a good income and getting your savings on track are central to building a strong financial foundation. But too many college graduates let debt undermine their money goals. If you ignore it, your debt could eat up your paycheck, stress you out, and hold you back from reaching your goals.

To prevent that from happening, make a plan to pay off — or at least responsibly deal with — your existing debt. If you have student loans, they’re likely your biggest debt since the average student debt for 2017 graduates was $39,400.

Make sure you’re aware of all the federal or private student loans you have and that you’re making payments each month. Use a calculator to estimate your minimum payments and how much interest you’ll pay over the life of your loan.

If you can’t afford your student loan payments, look into ways to lower them, such as enrolling in an income-driven repayment plan or refinancing your student loans. You might even be able to pause your payments with deferment or forbearance.

If you can comfortably make your payments, consider putting a bit extra toward your student debt each month. Paying more than the minimum will get you out of debt faster and save you money on interest.

Lastly, be cautious about taking on new debt. With credit cards, a good rule is to never charge more than you can easily pay off each month. If you need to buy a car, shop around for auto loans to find low rates with affordable payments.

Juggling all your new financial and career responsibilities isn’t easy. But it’s important to pay attention to your money, get yourself on the right path, and steer clear of major mistakes. With some wise moves and a bit of luck, you can use your first job to fast-track yourself to success.

Contributed by Elyssa Kirkham, Financial Expert at Student Loan Hero.